How to Invest in Stocks: A Comprehensive Guide

Stock market investing is a great way to grow your money gradually. Investors of all experience levels will benefit from this guide's detailed explanations, helpful hints, and insightful observations.

Introduction

Long-term wealth growth can be significantly aided by making strategic investments in various publicly traded companies. However, especially for those who are just starting out, the world of stocks might appear to be extremely complicated and scary. In this tutorial, we'll explain how to invest in stocks through a series of straightforward procedures that anyone can understand. You will find helpful insights and guidance that you can put into practice here, regardless of whether you are just beginning your investment strategy or are trying to develop it.

You may also like : "How to Sell on Amazon"

How to Invest in Stocks

Buying ownership shares in a company through stock investing entitles you to a portion of the profits generated by that company as it expands and thrives. The following is a detailed instruction manual on how to get started:

- Understand Your Financial Goals: Determine your long-term financial goals before making any investments. Investing for your retirement, purchasing a home, or producing additional income—do any of these interest you? Your objectives will determine the investment approach that you take.

- Educate Yourself About Stocks: Invest some time in educating yourself about the fundamentals of stock trading, such as the operation of stock markets, the distinction between common and preferred stocks, and the meaning of dividends.

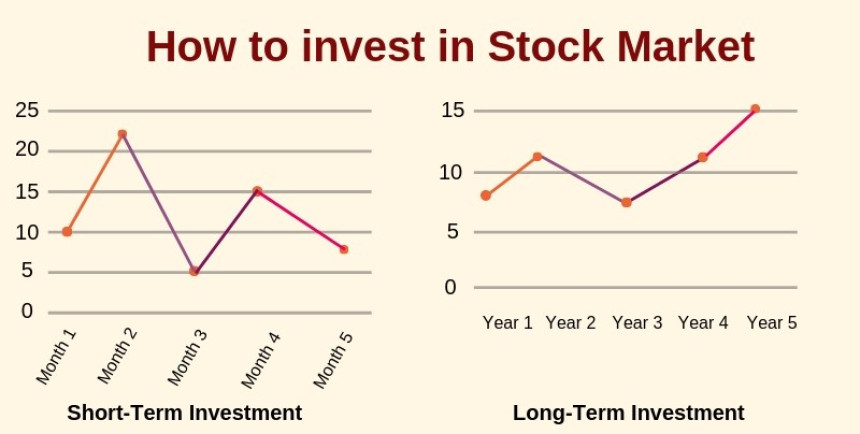

- Assess Your Risk Tolerance: It is essential to evaluate how much risk you are willing to take before investing in stocks because stocks come with dangers. Think about things like your age, your current financial condition, and how willing you are to deal with the ups and downs of the market.

- Create a Diversified Portfolio: Investing in a wide range of stocks that operate in a variety of markets helps to distribute risk across the portfolio. In the event that one industry underachieves, this can assist reduce losses.

- Decide Between Individual Stocks and Funds: You have the option of investing in individual stocks, mutual funds, or exchange-traded funds (ETFs), among other investment vehicles. The quick diversification and expert management that funds offer are two key benefits.

- Choose an Online Brokerage: When you want to purchase and sell stocks, you should use an online brokerage platform from a recognized company. Look for minimal costs, user-friendly interfaces, and educational materials when selecting a financial institution.

- Research Companies: When investing in individual stocks, it is important to do extensive research on the companies in which you are investing. Investigate their overall financial health as well as their performance and prospects for growth.

- Analyze Stock Performance: Investigate the past performance of a stock using the charts and ratios provided by the financial market. This can provide you with information about how the stock has performed over the course of time.

- Develop an Investment Strategy: Make a decision as to whether you want to be a value investor who focuses on stocks that are undervalued or a growth investor who targets stocks that have a strong potential for growth.

- Start with a Watchlist: You should compile a watchlist of the stocks that interest you. Keep an eye on their performance while you look for the ideal window of opportunity to invest.

- Practice with Virtual Trading: If you're new to the world of investing, you may get some practice under your belt on a number of different platforms that offer virtual trading.

- Open and Fund Your Account: When you are ready, open a brokerage account and deposit an amount that corresponds to the level of risk that you are willing to take.

- Make Your First Investment: Make your first investment in the stock market using the research and strategy you've developed. You should begin with a little amount and gradually increase it as your confidence grows.

- Monitor and Rebalance: Maintain a regular review schedule for the performance of your portfolio. Rebalance the portfolio by selling equities that are doing well and buying stocks that are doing poorly.

- Stay Informed: Maintain a current awareness of the latest market trends, economic developments, and company announcements. Acquiring knowledge is essential for making judgments about investments that are informed.

You may also like : "How to Buy Bitcoin on eToro"

Conclusion

The process of investing in stocks is a journey that demands knowledge, patience, and the ability to think in the long run. You may make well-informed investing selections that have the potential to enhance your wealth over time if you grasp the fundamentals, undertake extensive research, and keep updated. Keep in mind that investing involves risk; therefore, it is crucial to invest only the amount of money that you can afford to lose. Begin with a modest investing portfolio and gradually expand it as you gain expertise and knowledge from previous transactions.

You may also like : "How to Make Money Online"

FAQs

Can I invest with a small amount of money?

- Yes, many online brokers allow you to start with a small investment, sometimes as little as $10.

How do I choose between stocks and bonds?

- Stocks offer higher potential returns but come with higher risk. Bonds are generally more stable but offer lower returns.

What's the best time to buy stocks?

- Timing the market perfectly is challenging. It's better to focus on the quality of the stocks you're buying.

Do I need to constantly monitor my investments?

- Regular monitoring is important, but avoid making impulsive decisions based on short-term fluctuations.

How can I mitigate risks when investing in stocks?

- Diversification, thorough research, and a long-term perspective can help mitigate risks.

Should I seek professional financial advice?

- If you're unsure about your investment strategy, consulting a financial advisor can provide valuable guidance.

Tags

#Stock Investment Guide, #How to Invest in Stocks, #Investing for Beginners, #Stock Market Basics, #Building Wealth through Stocks, #Stock Investment Tips, #Diversifying Your Portfolio, #Online Brokerage Platforms, #Researching Companies for Investment, #Stock Performance Analysis, #Investment Strategy Development, #Starting with a Watchlist, #Practicing Virtual Trading, #Opening a Brokerage Account, #Making Your First Stock Investment, #Portfolio Monitoring and Rebalancing, #Staying Informed in the Market, #Small Investments in Stocks, #Stocks vs. Bonds Comparison, #Timing for Stock Purchase, #Mitigating Risks in Stock Investment, #Professional Financial Advice for Investing, #Long-Term Perspective in Investing, #Expert Insights on Stock Investment, #Growing Wealth through Stock Market, #Building a Successful Investment Portfolio