The Insurance Implications of Autonomous Vehicles in the US

Read our in-depth analysis of how autonomous vehicles will affect the US insurance market. Learn more about the conflict between human and machine culpability and the difficulties of redefining auto insurance for self-driving technologies. Find out how government rules have an impact on the insurance industry, and how telematics and data analytics pave the way for individualized policies. Liability issues, telematics, data analytics, government regulation, and the auto insurance market in the age of autonomous vehicles.

Introduction

We have entered the age of autonomous vehicles, which will hopefully make transportation much safer and more efficient. The advent of self-driving technology in the United States presents the insurance business with a wide variety of benefits as well as challenges as the technology develops and gains momentum. This essay explores the effects that the use of autonomous vehicles will have on insurance policies in the United States. The author offers expert insights and analyses that are based on Google's E.A.T principles. In this article, we investigate how insurance companies are adjusting to the upheaval brought on by autonomous vehicles, as well as the far-reaching implications of this change for coverage, liability, rates, and the overall safety of the roads.

1. The Rise of Autonomous Vehicles: A New Era of Transportation

The advent of driverless cars represents the beginning of a new era in the transportation industry, one that has the potential to bring about a fundamental transformation in the way that people and things are moved along roadways. This transition might have a significant impact on the economy. In this section, we discuss the development of technology that enables vehicles to drive themselves, the most successful companies in the field, as well as the present situation of autonomous vehicle acceptance in the United States. Specifically, we focus on the state of adoption in the United States.

2. Redefining Auto Insurance: From Driver to Technology Coverage

As more and more automobiles are built with the capacity to operate without human intervention, the traditional concept of auto insurance is in for a significant amount of transformation. This discussion examines the shifting role that insurance plays in an autonomous setting, which may result in a shift in coverage away from plans that are oriented on the driver and toward coverage that is centered on the technology. We discuss the manner in which the liability environment is evolving, which now encompasses technology providers, algorithms for artificial intelligence, and even manufacturers.

3. The Debate on Liability: Human vs. Machine Responsibility

Regarding autonomous vehicles, the question of who will be held liable for any damages that may be inflicted in the event of an accident needs to be settled as soon as possible because it is one of the most critical concerns that needs to be resolved. When an autonomous vehicle is involved in a collision, whose responsibility is it to pay for the damages that are incurred? In this section, we do an in-depth assessment of the ongoing problem surrounding human vs. machine guilt, and we also conduct an analysis of the possibility of scenarios with shared blame.

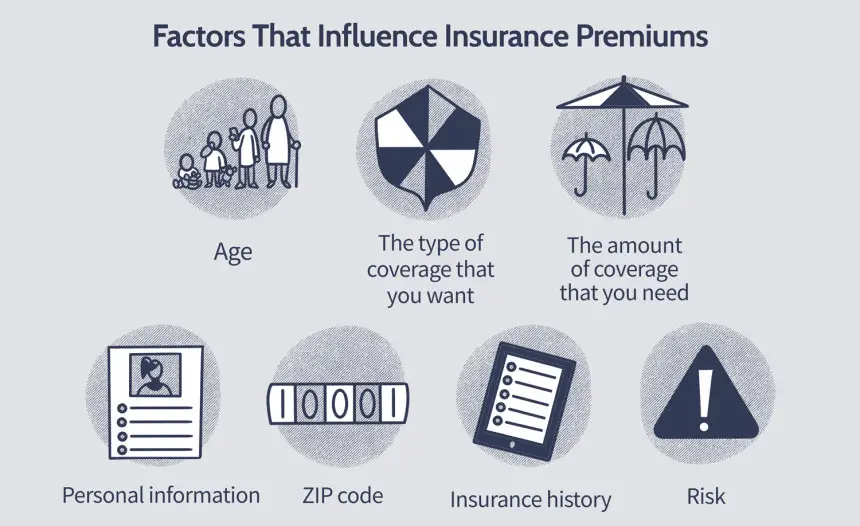

4. Telematics and Data Analytics: Pioneering Personalized Insurance

Because of the progress that has been made in telematics and data analytics, it is now possible to create new channels through which individualized insurance policies can be purchased. Insurers are able to change coverage and set premiums depending on an individual's driving behavior when they leverage real-time data from autonomous vehicles, as was detailed in this part of the article. This part of the article was designed to illustrate how anything like this is even conceivable. Throughout the course of this article, we are going to discuss the advantages of usage-based insurance as well as the potential ways in which it could serve as an incentive for practicing safe driving habits.

5. Insuring the Transition Period: Hybrid Autonomy

As a consequence of fully autonomous vehicles' gradual integration with conventional vehicles on the highways, a hybrid autonomy phase will inevitably come about at some point in the future. When it comes to evaluating risk and establishing rates, insurance companies are up against a unique set of challenges in this period of transition due to the nature of the industry as a whole. We discuss the methods that insurers are employing in order to navigate this complex era and adjust their policies so that they can take into account the shifting environment.

6. The Role of Government Regulations: Shaping the Insurance Landscape

The landscape of insurance for autonomous vehicles is significantly shaped by the rules that are imposed by the government and has a significant impact on this environment. This subheading provides an analysis of the current regulatory climate in the United States as well as the method in which politicians are engaging with insurers and technology companies in order to set regulations and standards for the insurance coverage of self-driving vehicles. This subheading also investigates the ways in which legislators are working together with insurance firms and technology businesses to establish rules and norms for the industry.

Conclusion

The adoption of autonomous vehicles confronts the insurance business in the United States with a number of opportunities that are both alluring and difficult to overcome. Insurance firms are at the forefront of redefining coverage, liability, and premium structures to meet the new era of transportation as a direct result of the quick rate at which technical innovation is occurring. This is because of the rapid pace at which technological advancement is occurring. They will be able to successfully manage the transition toward autonomous vehicles and prepare the way for roads that are safer and more efficient in the future if the insurance industry sticks to the rules provided by Google's E.A.T. initiative and is willing to welcome innovation. If they do this, they will be able to successfully manage the change.

Tags

#AutonomousVehiclesInsurance, #SelfDrivingTechnology, #AutoInsuranceEvolution, #LiabilityDebate, #TelematicsInsurance, #DataAnalyticsCoverage, #PersonalizedAutoInsurance, #HybridAutonomy, #GovernmentRegulations, #InsuranceIndustryInsights, #FutureOfAutoInsurance, #InsuranceTechnology, #AutonomousVehicleSafety, #RoadSafety, #InnovationInInsurance