Are Insurance Settlements Subject to Taxation? Exploring the Tax Rules and Regulations

Learn about the tax laws and standards that apply to insurance settlements in the US. Insurance payouts – are they taxable? Investigate the tax repercussions and discover how the IRS views both compensatory and punitive settlements. Know the tax implications of insurance payouts.

To protect people and organisations from unforeseen dangers and losses, insurance is essential. The basic goal of insurance, whether it be for a car, health, house, or life, is to offer financial security and peace of mind. However, there are frequently concerns raised about the taxability of insurance payouts. Are insurance settlements tax deductible? Let's examine the tax laws and guidelines that apply to insurance settlements in the US.

When a policyholder experiences a loss or makes a claim that is covered by the insurance, settlements are normally paid out to them. These payouts may result from a variety of insurance policies, such as auto insurance for automobile damage or medical insurance for medical costs. The nature of the settlement, its function, and the relevant tax rules are only a few of the variables that affect how insurance settlements are taxed.

It's critical to distinguish between the two primary types of insurance settlements—compensatory settlements and punitive settlements—in order to comprehend the taxability of insurance settlements. Punitive settlements aim to punish the party responsible for the loss, whereas compensatory settlements strive to compensate the insured for genuine damages sustained. These two forms of settlements may have very different tax treatment.

In the United States, compensatory insurance settlements are often exempt from federal income tax. The settlement sum is not regarded as taxable income by the Internal Revenue Service (IRS) if it is used to compensate medical expenditures. In a similar vein, a settlement that compensates for property damage is often not subject to taxes.

It's crucial to keep in mind that tax regulations can be complicated, and there may be exclusions or other unique situations that could affect whether insurance settlements are taxable or not. For instance, the tax treatment may change if a settlement includes money for emotional distress or pain and suffering. In these situations, it is advisable to seek advice from a tax expert to guarantee compliance with the relevant tax laws.

Punitive settlements may be subject to a separate tax treatment. Punitive settlements are meant to hold the offending party accountable for their acts, not to make up for the insured's losses. Punitive damages earned as part of an insurance settlement are typically taxable as income, according to the IRS. These agreements provide additional compensation for the defendant's wrongdoing rather than loss reimbursement.

The taxability of insurance settlements may also be governed by state-specific legislation because it's crucial to note that tax laws can differ from state to state. Certain forms of insurance settlements are excluded from state income tax in some jurisdictions under particular regulations. Therefore, while assessing the financial ramifications of insurance settlements, it's imperative to take into account both federal and state tax laws.

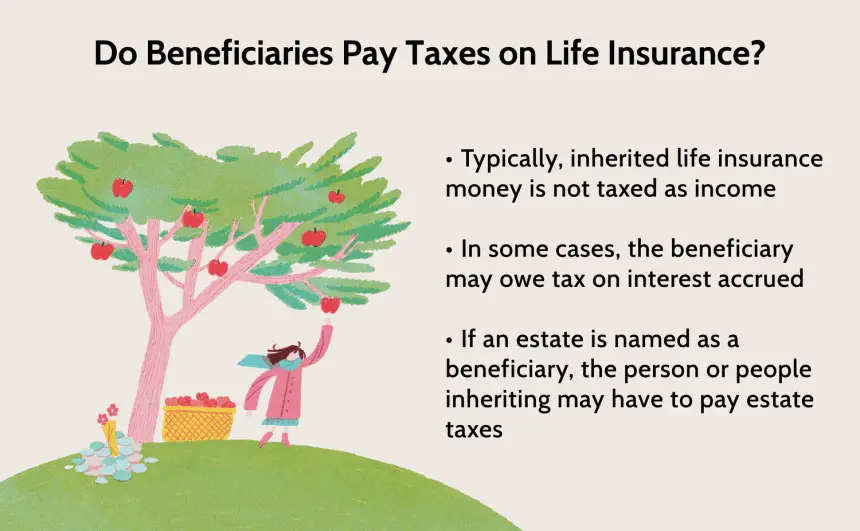

Other types of insurance payouts, aside from compensatory and punitive settlements, may have tax repercussions. For instance, a death benefit payment made to the owner of a life insurance policy is often not taxable. The IRS views the payout from a life insurance policy as a return of premiums paid as opposed to income. But the policy's interest or other investment profits can be subject to tax.

A person's tax treatment for receiving disability insurance benefits may also change based on how the premiums were paid. The benefits are normally not taxable if the premiums were paid with after-tax money. The benefits would typically be taxable, though, if the premiums were paid with pre-tax funds, as in the case of an employer-sponsored plan.

In summary, a variety of factors, including the kind of settlement, its purpose, and the applicable tax laws, determine whether insurance settlements are taxable. Punitive settlements are frequently taxed, although compensating settlements that make up for real damages are frequently exempt from taxes. However, there might be exceptions and special circumstances that have an impact on the tax treatment. To ensure compliance with the complex tax rules and determine the tax implications of insurance payouts in your specific situation, you should seek the advice of a tax specialist.

In conclusion, it is essential to comprehend the tax laws and regulations pertaining to insurance settlements in order to properly determine their taxability. Punitive settlements and other types of insurance payouts may have tax repercussions, even if compensating settlements are frequently tax-free. It is always advised to seek professional guidance when navigating the complexities of the tax system. Individuals and companies can efficiently handle the tax ramifications of insurance settlements in the United States by remaining aware and adhering to the relevant tax legislation.

TAGS

#Insurance, #are_insurance_settlements_taxable