How to Choose the Best Health Insurance Plan: A Complete Guide

Navigate the complex world of health insurance with our comprehensive guide on how to choose the best health insurance plan. Discover key factors to consider, compare coverage options, and make informed decisions for your well-being. Your ultimate resource for securing the right health insurance for a healthier future.

Introduction

Choosing a health insurance plan is one of the most important financial decisions you can make. With the right plan, you’ll have access to affordable healthcare that meets your needs. With the wrong plan, you could end up with expensive out-of-pocket costs and limited coverage.

This complete guide will walk you through everything you need to know to choose the best health insurance plan for your situation. We’ll cover topics like plan types, provider networks, covered services, and key terms you need to understand. You’ll also find a detailed comparison table of popular plan types and an FAQ section to help you make sense of it all.

You may also like : "Breaking Taboos: The Honest Truth About Non-Surgical Breast Augmentation"

Key Things to Consider When Choosing a Health Insurance Plan

As you evaluate health plans, keep the following key factors in mind:

- Coverage and Benefits: Make sure you understand what services are covered, such as doctor visits, hospitalizations, prescriptions, dental and vision care. Also understand the out-of-pocket costs like deductibles, copays and coinsurance.

- Provider Network: Check to see if your preferred doctors, hospitals and pharmacies are in-network. Going out-of-network results in higher costs.

- Prescription Drug Coverage: If you take any medications, check details like cost tiers, restrictions and whether your drugs are covered.

- Plan Type: Major types include HMO, PPO, POS and HDHP. Learn the differences between plan types.

- Metal Tier: Bronze, silver, gold and platinum plans have different premium costs, deductibles and coverage levels.

- Cost: Consider the monthly premium as well as out-of-pocket costs like deductibles, copays and coinsurance. Government subsidies may be available.

Let’s explore these factors and key health insurance terms in more detail.

Health Insurance Plan Types

There are several major types of health insurance plans, including:

- HMO (Health Maintenance Organization): Provides care from a network of doctors and hospitals. Lower costs but less flexibility - you need referrals to see specialists.

- PPO (Preferred Provider Organization): Gives flexibility to see out-of-network providers but you’ll pay more. No referrals needed for specialists.

- POS (Point-of-Service): Hybrid between HMO and PPO plans. Usually need referrals for out-of-network care.

- HDHP (High-Deductible Health Plan): Lower premiums but you pay 100% of costs until you reach the deductible. Often paired with HSAs.

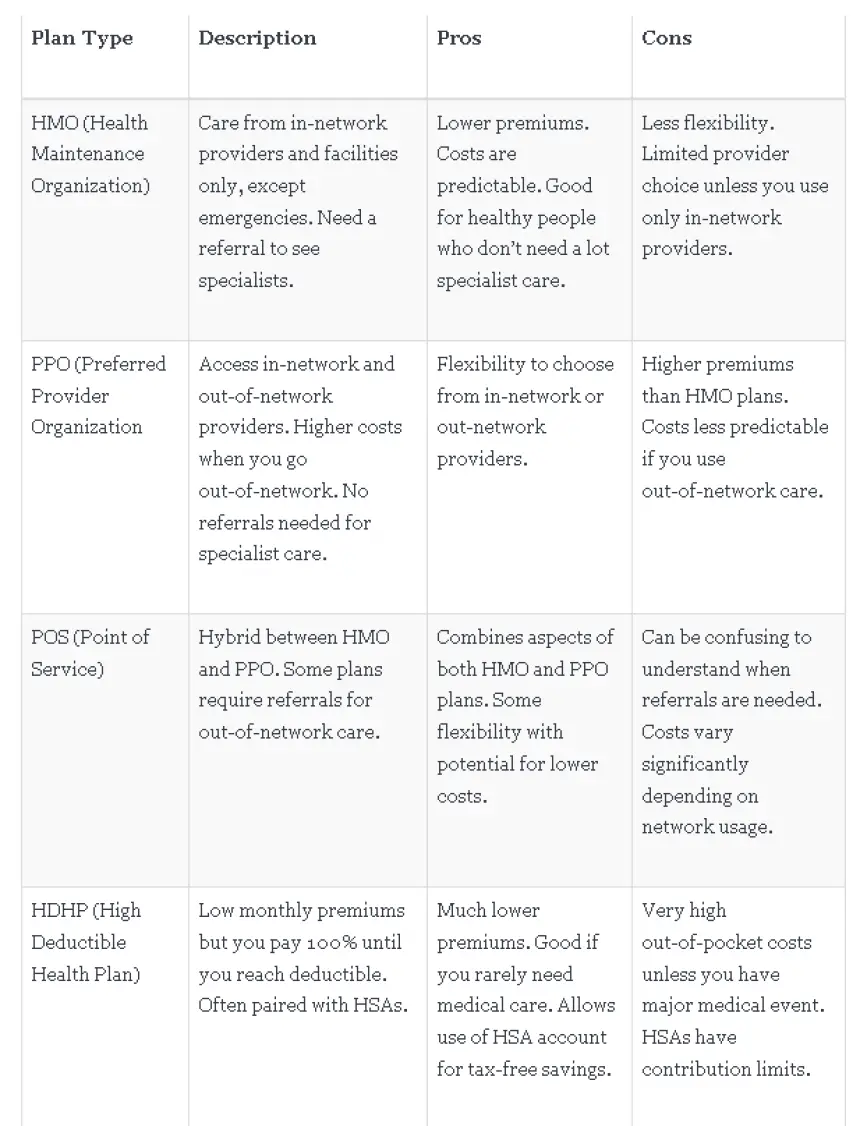

Here is an overview comparison of the major health plan types:

When choosing a plan type, think about your expected healthcare needs, preference for provider choice flexibility, and willingness to take on out-of-pocket costs.

Metal Tiers of Health Insurance Plans

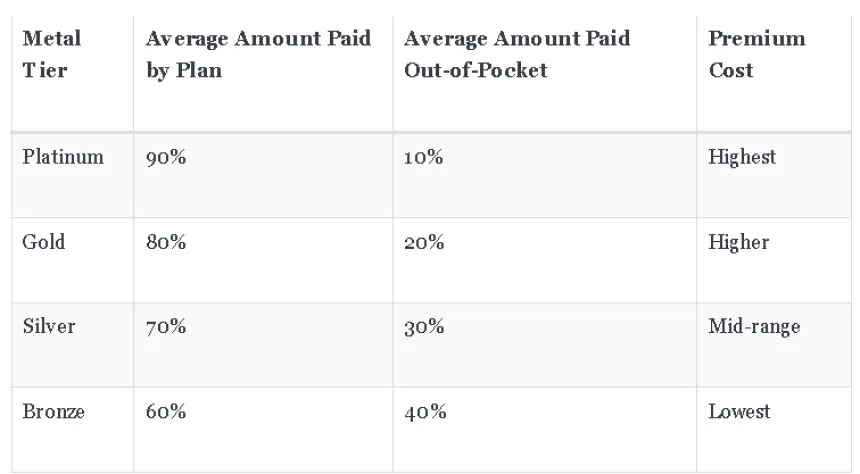

Health insurance plans are categorized into metal tiers - platinum, gold, silver and bronze. These tier names refer to the average amount of healthcare expenses that the plan covers, with platinum plans covering the greatest percentage of expenses.

Here is an overview of the metal tiers:

For example, silver plans cover an average of 70% of members’ healthcare expenses. Members pay the remaining 30% out-of-pocket through deductibles, copays, and coinsurance.

Higher metal tier plans have higher monthly premiums, but lower annual deductibles and copays. This can make sense if you expect to use lots of healthcare services. Lower tier plans have lower premiums but you pay more when you access care.

Bronze and silver plans tend to be the most common choices on the healthcare exchanges.

Choosing Providers and Provider Networks

An important factor in choosing a health insurance plan is making sure your preferred medical providers - doctors, specialists, hospitals etc. - are considered in-network by the plan.

Seeing out-of-network providers results in significantly higher out-of-pocket costs for you, or the providers may not accept your coverage at all.

You can check if your providers are in-network by contacting the plan or searching provider directories on the plan website. Consider providers you see regularly as well as major health systems and hospitals in your area that you would want coverage to access in an emergency.

If keeping your doctors covered under insurance is extremely important to you, start your health plan search by finding the plans and networks they accept rather than trying to match providers to plan networks after choosing a plan.

Be aware that provider networks can change year to year even if you don’t switch plans. It’s wise to double check your key providers each enrollment period.

Understanding Covered Services

Health plans cover a variety of medical services, but coverage details can vary greatly between plans. Make sure to understand exactly what benefits and services are covered before enrolling in a plan.

Key services to evaluate coverage for include:

- Doctor office visits and specialist visits

- Hospital visits

- Emergency room services

- Diagnostic testing (e.g. MRI, CT scans, labs)

- Surgeries

- Preventive care and annual check-ups

- Maternity and newborn care

- Mental health and substance abuse treatment

- Prescription drug coverage

Health insurance plans sold through the healthcare exchanges must offer coverage in 10 Essential Benefit categories:

- Outpatient care

- Emergency services

- Hospitalization

- Pregnancy, maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services including dental and vision care

Understanding gaps in covered services can prevent unexpected healthcare bills down the road. Always check the plan’s documentation like the Summary of Benefits and Coverage or Evidence of Coverage documents for details.

You may also like : "Safety First, Pleasure Always: A Comprehensive Guide to Using Condoms the Right Way"

Choosing Prescription Drug Coverage

If you take any prescription medications, pay special attention to how plans cover drug costs. Details to understand include:

- Cost Tiers: Most plans categorize drugs into tiers (e.g. Tier 1, 2, 3, etc.) with different out-of-pocket costs for each tier.

- Formulary List: This is the plan’s list of covered prescription drugs. Check that all your medications are listed or alternatives are covered.

- Prior Authorization: For some expensive drugs, plans require approval that the medication is medically necessary before covering it.

- Step Therapy: Similarly, plans may require you to try less expensive drug alternatives before they will cover certain medications.

- Quantity Limits: Plans limit the amount of certain medications they will cover per month.

- Generic Substitution: Some plans require you to use a generic version of a drug if available, rather than the costlier brand name.

Closely evaluating prescription medication coverage is crucial to finding affordable treatment.

Understanding Key Health Insurance Terms

As you navigate health insurance plans, you’ll encounter a lot of key terms and concepts. Here are some of the most important ones to know:

- Premium: The upfront amount you pay each month for health insurance. Premium costs vary greatly between plans.

- Deductible: The amount you pay out-of-pocket for covered medical services each year before insurance kicks in. Common amounts are $1,000 to $8,000 depending on plan type.

- Copay: A fixed fee (e.g. $25) you pay each time you access care. Applies after you meet deductible.

- Coinsurance: Percentage (e.g. 20%) you pay for the cost of services. Applies after you meet deductible.

- Out-of-pocket maximum: The most you’ll pay in a year for covered medical costs including deductible, copays and coinsurance. After reaching this amount the plan covers 100%.

- Explanation of Benefits (EOB): Statement from the health plan breaking down what medical treatments and services were covered.

Having a handle on these terms helps you accurately compare costs across plans and estimate your total potential expenses.

Government Health Insurance Subsidies

If purchasing insurance through the healthcare marketplace exchanges, you may qualify for government health insurance subsidies to lower your costs if your household income falls below certain limits (up to 400% of the federal poverty level).

Subsidies come in two forms:

- Premium Tax Credits: These directly lower the amount you pay for your monthly health insurance premium. The credit amount depends on your income level and family size.

- Cost-Sharing Reductions: If eligible, these subsidies lower the out-of-pocket costs - deductibles, copays etc. - you pay when accessing medical services. Cost-sharing reductions apply specifically to silver tier marketplace plans.

When you fill out your application through Healthcare.gov, your eligibility for subsidies is automatically calculated. Be sure to understand any subsidies you qualify for as that can greatly impact which plans make financial sense.

Choosing Health Insurance When You Have Medicare

If you are age 65 or older or have certain disabilities, you likely qualify for Medicare - the federal health insurance program for seniors and other vulnerable populations.

The decisions around choosing insurance work differently when you become eligible for Medicare. Some key points:

- You cannot purchase a private insurance plan from the healthcare marketplace exchanges once you are eligible for Medicare (with select exceptions).

- Everyone pays a premium for Medicare Part B to get medical insurance coverage. You can choose whether to enroll in Part D for prescription drug coverage - this requires an additional premium.

- Rather than selecting a metal tier, you pick whether you want Original Medicare or a Medicare Advantage Plan. Medicare Advantage plans bundle Part A, Part B and usually Part D together and are offered by private insurers.

- You still have deductibles, copays and coinsurance. These amounts vary greatly between Medicare Advantage plans.

- Your Medicare options and choices happen during defined election periods rather than open enrollment - speaks with a Medicare insurance broker to understand timelines.

Understanding how to coordinate Medicare with other insurance options takes expert guidance but is essential for keeping healthcare costs manageable while on a fixed income.

Questions to Ask When Comparing Health Insurance Plans

As you evaluate options during open enrollment, leveraging these key questions can help compare plan benefits and costs:

Doctor and Provider Coverage

- Is my primary care doctor in-network or do I need to switch?

- Are my preferred specialists in-network?

- Which major hospital and health systems are in-network near me?

Covered Services

- What standard medical services are not covered or have coverage limits?

- Does the plan cover my needed prescriptions and expected treatment services?

- What benefits are fully covered with no out-of-pocket costs due to ACA requirements?

Costs

- What is the total potential out-of-pocket cost if I get very sick or injured?

- What subsidies do I qualify for through the marketplace?

- What ancillary benefits like dental or vision come with the plan?

Having the right information to make an informed health plan decision can provide significant long term cost savings and prevent frustration in accessing care.

The Bottom Line on Choosing Health Insurance(Conclusion)

Selecting health insurance is an investment in your health, financial protection and peace of mind. Now that you know the key factors like plan types, coverage details, provider networks, costs and subsidies, you’re equipped to make the right health plan decision.

Be sure to study options with an understanding of your expected healthcare usage and budget. Finding the sweet spot between premium costs and out-of-pocket expenses can provide significant long term savings.

With the right health insurance partner, you gain the power to access quality care whenever you need it while keeping your finances intact. Here’s to your health and continued wellbeing!

You may also like : "Condom Confessions: Real Talk and Expert Advice on Using Protection with Passion"

Health Insurance Plan Choosing FAQs

We hope this guide covered all the major points you need to choose a health insurance plan. Here we’ve compiled answers to some frequently asked additional questions:

Do I have to re-enroll in marketplace health insurance every year?

- Yes, marketplace health plans run on an annual basis. Each year during open enrollment you must actively select a plan or HealthCare.gov will disenroll you. Open enrollment spans November 1 to December 15 each year for coverage effective January 1.

When is the earliest my health plan coverage starts?

- For individual plans purchased via the marketplace exchanges during fall open enrollment, the effective date is January 1. No matter when in open enrollment you sign up, coverage cannot start before the new year.

Can I switch plans if I’m unhappy with my coverage mid year?

- Generally you cannot change marketplace health plans except during the defined open enrollment period each fall. However, certain life events like loss of your job, change in household status or change in income allow a special enrollment period.

Do deductibles reset each year I re-enroll in the same plan?

- Yes - your deductible and out-of-pocket maximum amounts reset to $0 at the start of each new plan year. What you spent previously does not carry over year to year.

What is the penalty if I don’t have qualifying health coverage?

- Since 2019 when the individual mandate penalty was repealed, there are no federal tax penalties for lacking health insurance coverage. However some states like California and Rhode Island do still penalize uninsured residents so check local laws.

We hope these frequently asked questions provide more insight as you navigate picking health insurance coverage. Reach out with any other questions.

Tags

Health insurance plan selection, Comprehensive guide for choosing health insurance, Factors to consider in health insurance choice, Policy comparison for health coverage, Affordable health insurance options, Premiums and deductibles analysis, Network coverage assessment, Understanding health insurance benefits, Primary care physician selection in insurance, Specialized coverage evaluation, Policy exclusions awareness, Prescription drug coverage assessment, Copayment and coinsurance explanation, In-network vs. out-of-network considerations, Health savings account (HSA) benefits, High deductible vs. low deductible plans, Maternity coverage in health insurance, Pre-existing conditions and insurance, Annual and lifetime maximums clarification, Emergency services coverage evaluation, Telemedicine options in health plans, Wellness programs and preventive care benefits, Reviews and ratings for insurance providers, Customer service satisfaction in health insurance, Open enrollment guidelines and timing.